5 reasons why Islamic finance should be on G20 policy reform agenda

Turkey is the 2015 host Presidency of the G20. India, Indonesia and Saudi Arabia are the other G20 countries with very large Muslim populations. Muslims in a number of other G20 countries are reportedly increasingly relying on government welfare programs. Therefore, any policy initiatives that the G20 countries will evolve will have far reaching consequences for the world as a whole and for its Muslim population in particular.

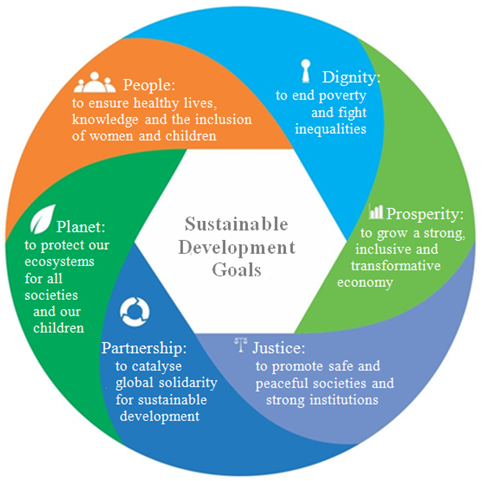

The most important common challenge of humanity is poverty and that was targeted in the past 20 years through the UN Millennium Development Goals (MDGs). Access to financial services is the key to accessing other vital services such as health, education, housing as well as accessing to business opportunities. Hence the year 2005 was celebrated by the United Nations as the “International Year of Microcredit: Building Inclusive Financial Sectors to the Achieve Millennium Development Goals (MDGs)” (UN 2006). The goal was to create a market driven and sustainable institutional environment that can be instrumental in achieving the MDG targets. The timeframe for the MDG targets ends with the year 2015, and despite progress in a number of areas the most important target of reducing absolute poverty remains distant in a number of the Islamic Development Bank (IDB) member countries (IDB 2009). In preparing for concerted global development efforts beyond 2015, the United Nations has redesigned the MDG targets in the form of Sustainable Development Goals (SDGs).

The schematic summary of the SDGs elements presented in Exhibit 1 is something akin to the Maqasid Al Shariah (guideposts for public policy in Islam) for achieving an inclusive and sustainable society. The Maqasid comprise of the promotion and preservation of – a) religious beliefs b) human intellect, c) human dignity, d) the interests of the future generations like environment and a debt-free society and e) wealth and prosperity (see, Chapra 2008). In context of the IDB member countries, a convergence between the SDGs and the Maqasid can be achieved by properly addressing the positive role that religion can play in enhancing effectiveness of policies. This factor drives Islamic finance and development in Muslim societies but it was either ignored or misrepresented in the MDGs target studies during the last decade.

The 2006 United Nations publication Building Inclusive Financial Sectors for Development (UN 2006) documented the barriers to accessing financial services and the options that the various stakeholders could possibly workout in their areas and jurisdictions to remove the barriers and enhance access to financial services. Among the many barriers identified were religious beliefs, social norms and usury ceilings (prohibiting lending rates commensurate with high cost of the micro-credit). Since then several initiatives have been put in place, numerous experiences documented and dialogue papers and research publications have been released addressing the promotion of financial inclusion. The most significant and recent of these efforts is the World Bank’s Global Financial Development Report 2014 – Financial Inclusion (World Bank, 2014). Most of what is reported and analyzed in this report is also highly relevant for enhancing financial inclusion through Islamic microfinance and finance for SMEs. CGAP (2008) also recognizes the role of Islamic finance in financial inclusion.

Exhibit 1 – Elements of Sustainable Development Goals

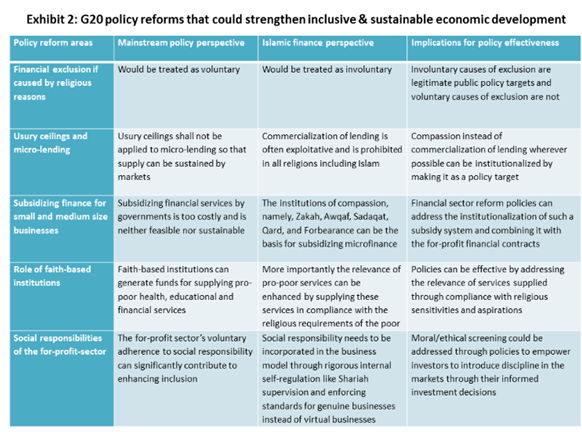

However, there are a number of pending issues as summarized in Exhibit 2, the proper resolution of which will contribute to ensuring effective policy interventions to achieve the SDGs targets.

- Recognize that religious barriers to inclusion are in fact involuntary

The mainstream policy focus on financial exclusion (specially, World Bank 2014) treats religious beliefs as a voluntary cause of exclusion. As a result of this approach, the removal of the faith-based barriers to accessing financial services doesn’t become a target of policies. On the other hand, Islamic finance treats such barriers as involuntary and hence tries to remove these barriers through direct policy action by providing religiously compliant financial services.

- Harness the power of compassion in subsidizing financial services for micro, small and medium enterprises

Due to the high cost of micro-lending, most mainstream policy literature calls for removing the usury ceilings for microcredit so that the services can be provided by the markets in a sustainable manner. As a result, the main criticism of the experience of microfinance practices emerges from the often exorbitantly high lending rates. Furthermore, Islamic finance treats the commercialization of lending as strictly prohibited by explicit religious injunctions. Keeping the high cost of micro-lending in consideration, it is neither feasible nor sustainable for governments to subsidize the large-scale needs for microfinance. The Islamic microfinance approach (IRTI 2008) addresses this dual challenge through a potential alternative service. The service is subsidized by bringing together the not-for-profit institutions of compassion such as Qard (interest-free loans), Forbearance, Zakah (obligatory religious charity), Awqaf (voluntary and organized religious charity), Sadaqat(unorganized and voluntary religious charity) and the for-profit Islamic financial contracts.

- Make the services relevant for the people through compliance with their religious beliefs

The significant potential of faith-based institutions in funding the pro-poor health, educational and other services is growingly being recognized in the mainstream policy framework. However, the policy literature doesn’t adequately recognize the risk of irrelevance of such services for people who may have been excluded due to the services being inconsistent with their religious beliefs. It needs to be recognized that educational, health and financial services will be more relevant if these can be perceived by people as consistent with their religious beliefs. This phenomenon is the raison d’etre of Islamic finance and its broader recognition in the mainstream policy studies could contribute to the effectiveness of policies.

- Enhance social responsibility of financial contracts by linking finance with real goods and services

The essence of the Basel III regulatory reforms is indeed to promote genuine businesses and to curtail unreal and highly leveraged activities. This consensus is reemphasized each time there is a financial instability and became more prominent after the global financial crisis. To this perennial phenomenon of global concern, Islamic finance has a direct relevance as finance is created only through the markets of real goods and services. In the first place this feature of Islamic finance appears to be highly costly, but in fact by promoting the markets for real goods and services the inherent feature offers a once for all solution to the recurring financial crisis.

- Spread the risk of deposits among depositors

The core feature of Islamic banking is the replacement of interest bearing deposits with profit sharing investment accounts (PSIAs). Interest bearing deposits concentrate the asset risks on the bank and PSIAs spread the risks among the various depositors. Hence inherently an Islamic bank would be more stable compared to a peer group conventional bank. However the PSIAs are also embedded with unique risks. Significant progress has already been made in best practice standards for addressing such risks including profit equalization reserves and investment risk reserves. IMF (2015) treats these reserves akin to the Basel III reserves and indeed in the Islamic banking industry the average actual capital adequacy is above 15% of the risk weighted assets. Actual minimum liquidity of the industry also exceed Basel III requirements. Hence G20 reforms to make room for PSIAs will actually be consistent with Basel III prudential standards.

In conclusion it is therefore suggested that as summarized in Exhibit-2 there are gaps existing in the international development policies. By filling these gaps the SDGs can be pursued more effectively. G20 policy reforms that will encourage Islamic finance will promote financial inclusion, will control financial leverage and will spread risks and enhance banking stability. Furthermore, such reforms can create the required institutional environment that can support the “institutions of compassion” for subsidizing financial services to the small, medium and micro-enterprises.