Oil Productions, Excess of Everything is bad

From US to OPEC

The reasons of decrease in oil prices are totally different from those that are being perceived. Supply glut, overproduction and slowing demands. Oil prices are on a free fall for four months now. The prices have decreased around 30% of the total, since hitting zenith of $104 per barrel in June, and now dropped as low as $70 per barrel. It’s considered the lowest since November 2010.

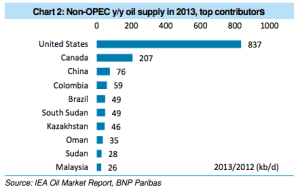

The massive US shale production and increase in non-OPEC (Organization of the Petroleum Exporting Countries) oil exports along with low consumption of oil; that has been decreased from 700,000 barrels per day to a lowest of 200,000 barrels per day and the decrease in economic growth in a wide range of countries has lead to this consequence.

In 2014 the total oil demand was expected to grow 1.05 million barrels per day, which is even less than the expected supply of non- OPEC alone i.e. 1.68 million barrels.

A strong US dollar is also worsening the situation, as it hits a 4-year high in October, said KAMACO. Similarly Dukas copy Bank explained that if US dollar were to fall, oil prices would have been supported more than what the market has recently seen but now a strong dollar and a weak oil price might provoke stock market melt-down.

RUSSIA, CHINA AND IRAN:

However Iran and the Russia see it the other way around. The price of the Russian flagship Urals crude blend has fallen to just over $80 per barrel, which is way below $144 that the state requires balancing its budget. Russia appears to be affected the most by these slumping oil prices, which will downgrade the Russian economic profile for the next several years. President Vladimir Putin openly proclaimed that “at some moments of crisis it starts to feel like it is the politics that prevails in the pricing of energy resources”

It was more like a direct finger towards the powers playing with the OPEC. President implanted the idea that US scrimmage over the Ukraine issue is what that caused the oil price plunge.

On the other hand Iran’s desire to exploit its oil revenues by building new oil field technologies may collapse altogether, it’s said that recent drop in oil prices is going to affect Iran’s economy much more than the western sanctions did in the past few years.

On the other end we see China’s delight over decrease in oil prices, the country seems to have bought 18 million barrels of crude oil from UAE and Oman. 36 cargoes of crude oil is the largest purchase that China ever made in a single month.

OPEC MEETING:

There was a chance that OPEC might bring some relief, but there is no signal from the biggest producer, Saudi Arabia, to cut productions. In fact the Kuwait and KSA are even against the idea of reduction in oil production quotas. The propagation of the same idea was seen in the November 27th meeting, Saudi Arabia, the largest producer of OPEC, declined the proposal of cutting the production or reducing the quota.

The last time OPEC reduced the quotas was in 2008 when price went from $114 per barrel to $32 a barrel and at the moment neither the circumstances are that critical nor the situation is that severe thus OPEC feels that the market can stabilize itself and all members were determined to stick with the 30 million barrel production per day as was decided on December 2011.

We understand that it is indeed a historic turning point when US oil production is escalated to 70% in the past 6 years with nine million barrels a day and reduction in OPEC quotas would further strengthen the US productions.

Therefore OPEC wants to stay relevant and it is the most strategic decision. This entire plunge was a cause of massive US shale oil production and this shale production wouldn’t be economically beneficial and effective if the prices continue to fall, and would give a hit that’d last a few years. Thus OPEC’s cut motions would only hurt OPEC in the long run. Well played!

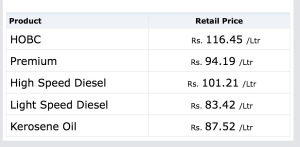

Positive news for Pakistan

Well, when it comes to Pakistan; as we aren’t an oil exporter country, so this oil price free fall is like an economic boost and a sigh of relief for the crisis stricken nation amid of political situation that the country is going through. This decrease in oil price is an indication of decrease in the price of the commodities in future. It’s like the much needed positive news!